Top 10 Ledger Vault Alternatives & Competitors

Research alternative solutions to Ledger Vault on G2, with real user reviews on competing tools. Cryptocurrency Custody Software is a widely used technology, and many people are seeking reliable, popular software solutions with institutional custody and verification. Other important factors to consider when researching alternatives to Ledger Vault include security and storage. The best overall Ledger Vault alternative is Coinbase Custody. Other similar apps like Ledger Vault are Zengo Wallet, Fireblocks, Fidelity Digital Assets, and Dfns. Ledger Vault alternatives can be found in Cryptocurrency Custody Software but may also be in Cryptocurrency Wallets or Stablecoin Infrastructure Software.

Best Paid & Free Alternatives to Ledger Vault

- Coinbase Custody

- Zengo Wallet

- Fireblocks

- Fidelity Digital Assets

- Dfns

- Swiss Crypto Vault

- BitGo

- AmbiVault

Top 10 Alternatives to Ledger Vault Recently Reviewed By G2 Community

Coinbase is a digital currency wallet and platform where merchants and consumers can transact with new digital currencies like bitcoin, ethereum, and litecoin.

Zengo Wallet is the crypto wallet for everyone. You can buy, trade, and earn BTC, ETH, and more (over 70 of the top cryptocurrencies) on one, simple and beautiful platform. It has bulletproof security and legendary customer support, with real support agents standing by 24/7 to answer any questions. Zengo’s 3-Factor authentication process ensures that 1) no one but you can control your crypto, and 2) your wallet is backed up, so even if you lose your phone, you can recover your crypto through a simple 2-step verification process. Here’s the best part: there’s no password to remember - or forget. No private keys to store - or lose. Zengo recognizes that people often represent the weakest part of a security matrix, and we’ve built that into the wallet’s design. It’s magic...and a lot of advanced cryptography :) Learn more about this industry-leading security standard here: https://zengo.com/security

Fireblocks is a comprehensive digital asset infrastructure platform designed to empower organizations of all sizes to build, manage, and scale their blockchain-based operations securely. By integrating advanced security measures with a user-friendly interface, Fireblocks streamlines the custody, tokenization, payment, settlement, and trading of digital assets across a vast ecosystem of exchanges, custodians, banks, payment providers, and stablecoin issuers. Trusted by over 2,000 institutions—including BNY Mellon, Galaxy, and Revolut—Fireblocks has securely facilitated more than $10 trillion in digital asset transactions across 100+ blockchains and over 300 million wallets. Key Features and Functionality: - Secure Digital Asset Storage: Utilizes Multi-Party Computation technology to ensure private keys are never fully exposed, distributing the signing process across multiple parties to eliminate single points of failure. - Asset Transfer Network: Facilitates secure and efficient transfers of digital assets between various parties, supporting a wide range of cryptocurrencies, stablecoins, and tokenized assets across multiple blockchain networks. - Tokenization Engine: Enables businesses to tokenize traditional assets—such as real estate, commodities, or securities—into digital assets that can be securely stored and transferred on the blockchain, enhancing liquidity and transparency. - Policy Engine: Automates governance policies for transaction rules and administrative approvals, allowing organizations to configure rules that dictate how transactions are handled and approved. - Compliance and Monitoring: Provides tools for real-time transaction monitoring and compliance with regulatory frameworks, employing mechanisms like Anti-Money Laundering and Know Your Transaction to prevent unauthorized activities. - Integration Capabilities: Offers secure API access and integration options, enabling seamless connectivity with existing infrastructure, third-party services, and decentralized finance platforms. Primary Value and Solutions Provided: Fireblocks addresses critical challenges in the digital asset space by offering a secure, scalable, and comprehensive platform that mitigates risks associated with cyber threats, internal fraud, and human error. By providing robust security measures, streamlined operations, and compliance tools, Fireblocks empowers institutions to confidently manage and transact digital assets, fostering innovation and growth in the blockchain ecosystem. Its end-to-end solutions simplify complex processes, reduce operational friction, and ensure regulatory compliance, making it an indispensable partner for businesses navigating the digital asset landscape.

Dfns is the leading wallets-as-a-service platform in web3. Startups, enterprises and financial institutions use Dfns to create, embed and manage programmable wallets at scale powered by the industry's most advanced MPC technology. Built by PhDs and experts in security and cryptography, Dfns is spearheading research in threshold signatures applied to key management. Since 2020, Dfns has helped ABN AMRO, Fidelity, Zodia Custody, FIFA and many others companies to create over a million wallets.

Swiss Crypto Vault developed a proprietary hyper secure cold storage concept. It applies the highest standards of cryptographic, IT and physical security as well as multi-party segregation and multi-signing features. The implementation is regularly reviewed by an independent third party.

BitGo is the digital asset infrastructure company, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have been focused on accelerating the transition of the financial system to a digital asset economy. With a global presence and multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, and millions of retail investors worldwide. For more information, visit www.bitgo.com.

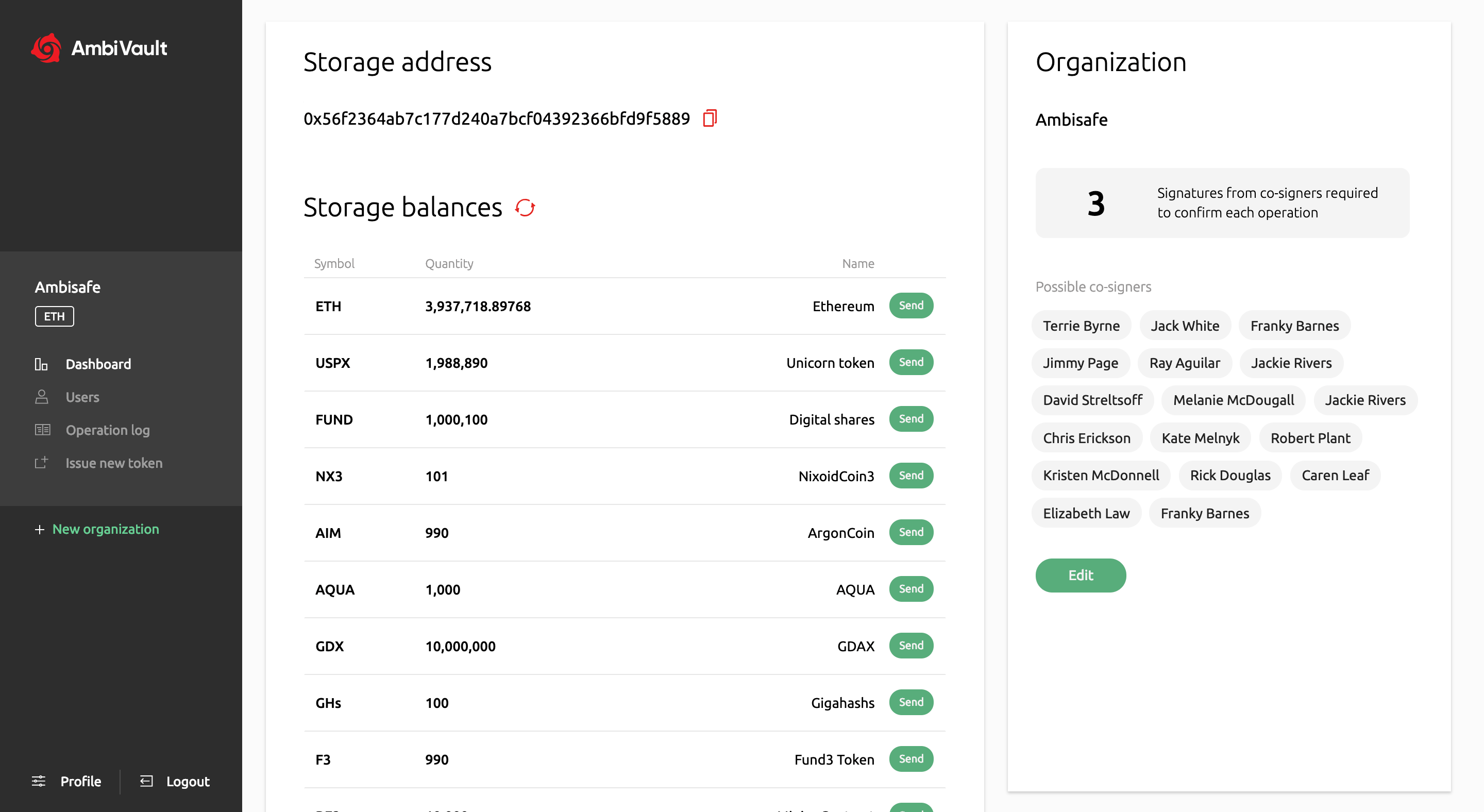

Enterprise multi-signature wallet for digital assets storage and management. AmbiVault helps to enhance the security of your digital assets from unauthorized access. Manage smart contract functions through a user-friendly interface.

itBit is a Leading Provider of Crypto Asset Custodial Services

Anchorage was founded on the belief that technical problems require technical solutions. To help financial institutions invest securely in digital assets, we are building the first crypto-native custodian.