Top 10 Ohpen Alternatives & Competitors

Looking for alternatives or competitors to Ohpen? Other important factors to consider when researching alternatives to Ohpen include reliability and ease of use. The best overall Ohpen alternative is AdvisorEngine. Other similar apps like Ohpen are VestmarkONE, T-Advisor, Jemstep, and RobotFX Fluid. Ohpen alternatives can be found in Robo-Advisory Software but may also be in Financial Services CRM Software.

Best Paid & Free Alternatives to Ohpen

- AdvisorEngine

- VestmarkONE

- T-Advisor

- Jemstep

- RobotFX Fluid

- Scalable

- Bambu

- WealthFy

Top 10 Alternatives to Ohpen Recently Reviewed By G2 Community

Robust platform with CRM, workflow management, and tools to help grow your wealth management and advising business.

VestmarkONE is a powerful, integrated platform that harmonizes key wealth management functions proposal generation, portfolio construction, trading, compliance monitoring, performance reports, and sleeve level accounting into an efficient single solution across all custodians, and helps you meet the increasingly complex demands of advising and servicing your clients while maximizing your productivity.

T-Advisor is a platform that allows clients to face the current market competitors with a tailor-made solution from a leader company with cutting-edge financial technologies.

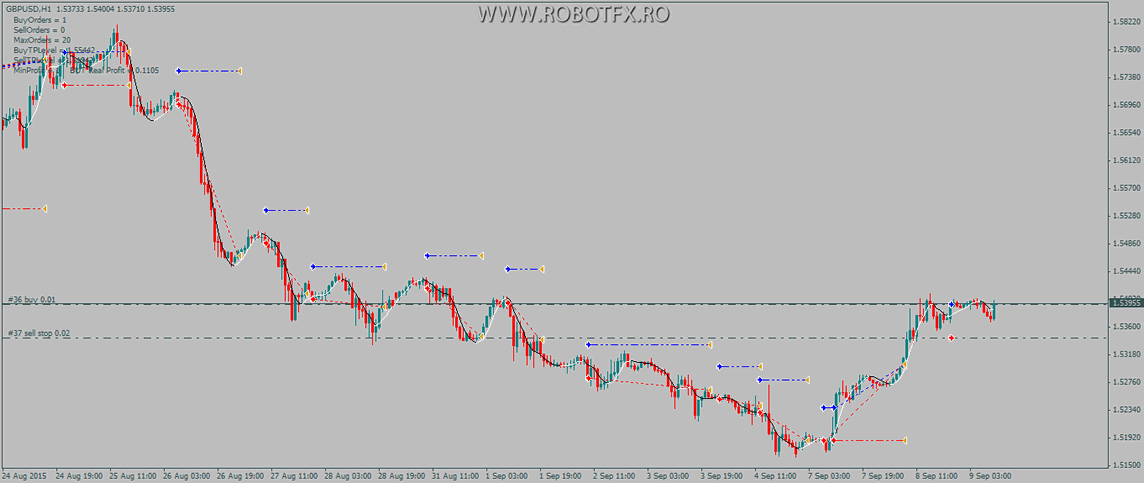

RobotFX Fluid is a MetaTrader advisor that detect the trend, opening/closing trades within a defined price movement (at precise entry/exit levels) and manage winning trades as well as recovering a lost trade.

Personalised, globally diversified and fully managed portfolio. Optimise your portfolio and monitor risk based on the latest quantitative research.

Bambu is a leading global provider of robo-advisory technology for businesses of every size and industry, from finance to commercial or even new disruptors, transforming the digital wealth space. It enables businesses to make saving and investing more straightforward and intelligent for their clients.

Valuefy is a global pioneer in cutting edge investment technology. We help enable smarter, data driven decisions at every stage of the investment lifecycle.

TradeCopier is a copy trading service offered by T4Trade, designed to cater to both novice and experienced traders. It allows users to either become Strategy Followers, who can automatically replicate the successful strategies of top-performing traders, or Strategy Providers, who can share their trading strategies and earn performance-based fees. Key Features and Functionality: - Strategy Follower: Users can subscribe to one or multiple Strategy Providers from a diverse leaderboard, enabling them to copy trades in real-time without the need for constant market monitoring. - Strategy Provider: Experienced traders can offer their strategies to a growing community of followers, generating additional income streams through performance fees. - Diverse Strategy Selection: The platform offers a wide range of strategies, allowing users to choose those that align with their financial goals and risk tolerance. - Time Efficiency: TradeCopier automates the trading process for followers, eliminating the need for manual trade execution and continuous market analysis. - Portfolio Diversification: By copying multiple Strategy Providers who trade various financial instruments, users can diversify their investment portfolios effectively. Primary Value and User Solutions: TradeCopier democratizes access to professional trading strategies, enabling users to participate in the financial markets without requiring extensive experience or time commitment. For beginners, it offers an opportunity to learn by observing and replicating the trades of seasoned professionals. For experienced traders, it provides a platform to monetize their expertise by sharing strategies and earning performance fees. Overall, TradeCopier simplifies the trading process, fosters knowledge sharing, and enhances portfolio growth opportunities for its users.

Helping personal and private banking business units realize their corporate digital advisory strategy, keeping a personal client relationship through high-end, accessible and personalized tailored investment advisory service delivered directly to their smartphones.