No matter how dry or stale people think accounting and finance is, these functions are vital to the health of any company. Felipe Torres, a financial analyst at G2, further explains that finance and accounting functions “...help us prepare for the future and drive strategies that ensure we're maximizing our potential.”

Finance and accounting software offer finance and accounting teams deeper insight into the financial well-being of a company, while managing key performance indicator (KPI) metrics. These departments keep track of the company’s heartbeat, ensuring they meet different financial goals.

It should be no surprise that the number of offerings in the accounting software and finance software marketplaces are quickly growing. These evolving products provide companies with advanced functionality, deeper reporting, increased efficiency, and expanded automation in their daily activities. In turn, companies manage resources more efficiently and utilize capital more responsibly.

This is the first of a monthly series about finance and accounting automation software.

Benefits of accounting automation

One of the most important features of this software is accounting automation and streamlining. This automation, or at least partial automation, can assist almost all facets of accounting, including: accounts payable (AP), accounts receivable (AR), general ledgers, balance sheets, cash flow reports, and profit and loss statements. Felipe adds that “automated processes in our line of work allows us to run more efficiently and assures a higher quality product.”

Most accounting systems have AP/AR functionality built in, but it’s not always sufficient and robust enough for companies of all sizes, whether they process a few invoices a day, or have to process thousands of invoices and deal with hundreds of suppliers. According to a 2017 Intuit study, accountants are spending 86% of their time on tasks that could be automated. Furthermore, the number of accountants and auditors will grow about 22% by 2024 in the business and finance sectors, according to the Bureau of Labor Statistics. These statistics highlight the importance and demand for accounting software that contains automated features to make routine processes instantaneous, freeing up resources for more complex tasks and analysis. This isn’t to say that automation is taking jobs/work away from humans. Torres continues, “With the time saved from automation, we can focus on more critical and impactful initiatives that help us maximize our potential and drive strategies that ensure we're prepared for the future.”

Common automated features of top-rated products

The top rated AP/AR products on G2 all share similar automated attributes that help streamline processes for accounting professionals.

| Some of these elements include: |

|

These characteristics enable companies of any size to reduce data entry, take greater control of approvals, catch mistakes earlier, and stay in sync with their current accounting systems. Less data entry and less mistakes allows accountants to go from collecting data and correcting errors, to making decisions faster. This can also lead to more efficient utilization of capital and better management of resources.

The importance of financial analysis

Financial analysis is essential in order for finance and accounting teams to spend less time doing repetitive work, and spend more time analyzing data and making informed decisions. Using historical data and trends to help predict financial outcomes and plan budgets, financial analysis software gives employees more accurate and relevant information when making decisions. Financial analysis also gives organizations further insight into whether they are profitable, how much cash they have, and if they have enough capital to invest in new lines of business. The three common types of reports used for financial analysis are income statements, balance sheets, and cash flow statements.

Other financial software that helps with automation is financial audit software, which automates auditing of several types of financial transactions, and financial close software, which helps automate the end-to-end financial close process.

Other important automation features

One of the most talked about (and disruptive) technologies to recently emerge is blockchain software.

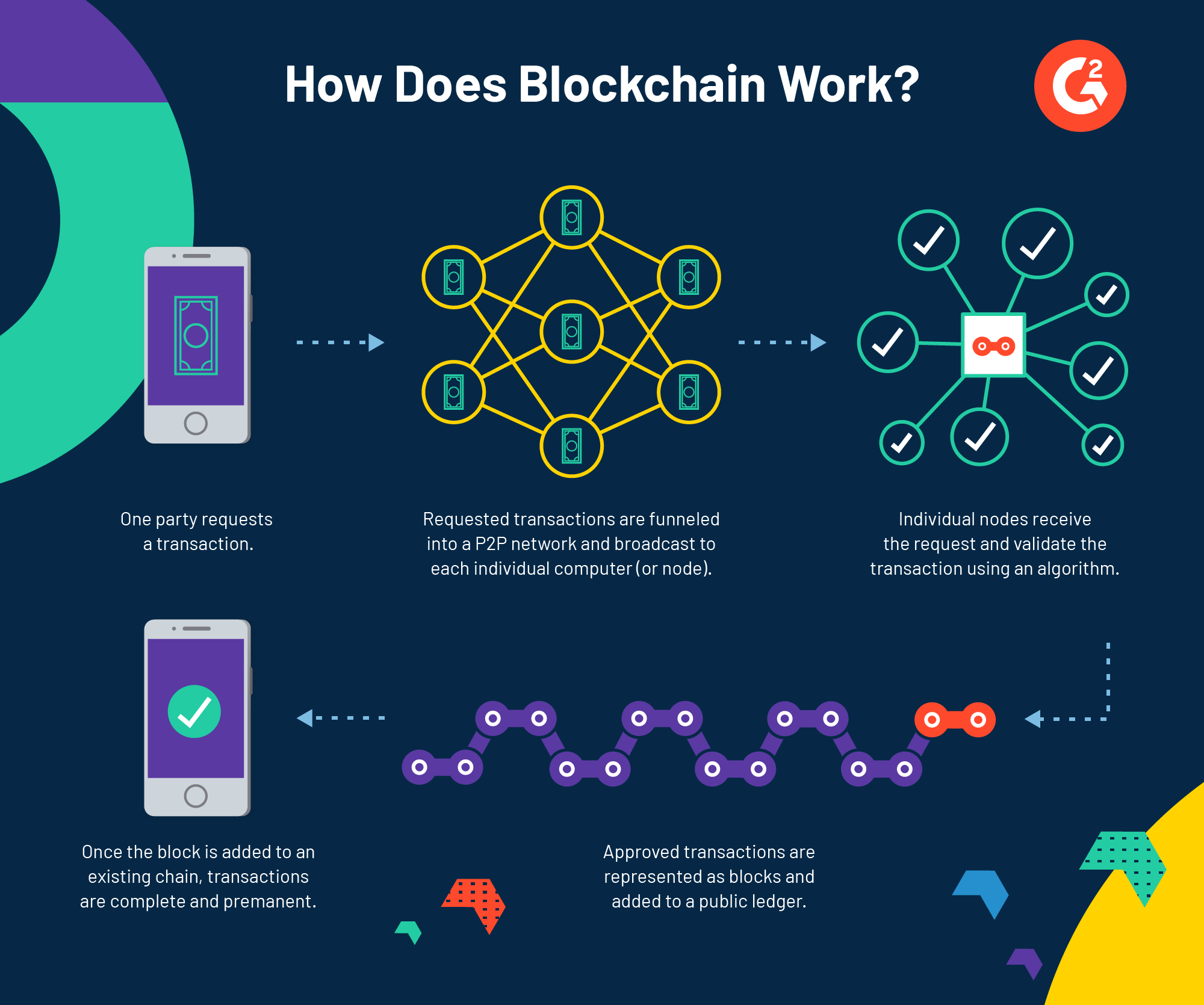

What exactly is blockchain? It’s an efficient, reliable, and secure system for transactions, that can’t be reversed or tampered with; it allows two parties to engage in secure digital transactions without a third party.

Blockchain could help accountants by automating asset and ledger recordkeeping, as well as reducing costs associated with maintaining these records. The Big Four accounting firms have begun investing in blockchain. It’s only a matter of time before more companies adopt blockchain into their business practices.

There are several accounting software that help automate processes, such as artificial intelligence (AI), remote accounting, and cloud-based accounting. In future articles, I will dive deeper into each of these topics, but for now I’ve included a brief description of each below.

-

-

Artificial intelligence

Artificial intelligence (AI) are software applications that incorporate machine learning and algorithms into everyday functionality to automate a variety of tasks for users. AI can be incorporated into any industry; accounting and finance teams can use this software to streamline data entry and analysis, reduce fraud, and enforce corporate policy by identifying noncompliance issues. -

Remote accounting

Remote accounting, or mobile computing, is the notion of accounting “on the go,” providing accounting professionals with the ability to work remotely using online portals and apps. This functionality gives employees the power to track financial data, manage accounts, and record expenses while outside of the office or away from their computers. With the ever-growing popularity of cloud-based computing and the widespread acceptability of electronic documentation, remote accounting is increasingly attractive to accountants. -

Cloud-based accounting

Cloud-based software allows users to access their software from anywhere they have an internet connection. The “cloud” gives companies access to financial information and other shared resources that run on the providers’ servers, making accounting duties more accessible and the whole process more efficient. Multiple people can access items and documents, while making changes and comments as needed. Cloud-based accounting is becoming more prevalent due to fewer barriers to entry and the need for fewer resources.

-

Artificial intelligence

The future...

...is now! Automatic services are now commonplace in many sectors of the financial industry, such as tax preparation software, yet the accounting sector has yet to fully emerge and benefit from these resources. As industries develop and change, and software becomes more efficient and widespread, change becomes necessary for growth and sustainability.

Because accounting and finance is the backbone of most institutions, it’s vital that these companies leverage software that helps automate and streamline as many processes as possible, freeing up time for other tasks. Automation is fueled by software advancement, and it’s up to each organization to stay up to date with trends, while fully utilizing the time- and money-saving potential these solutions can provide.

Want to learn more about Accounting & Finance Software? Explore Accounting & Finance products.

Nathan Calabrese

Nathan is a Research Principal at G2 focusing on finance and accounting software and their respective markets. Coming from the world of finance, Nathan understands and is familiar with the importance of finance/accounting software, and the complexities, struggles, and nuances that come with them. He has over 15 years of analytical experience in industries ranging from health care and transportation logistics to food service and software. Nathan received his MBA in finance and international business administration from the University of Illinois, Chicago, and his B.S. in production and operations management from California State University, Chico.