The business world is full of uncertainty, hazards, and surprising turns.

No company can completely control every risk they face. Sometimes it's possible to know what lies ahead, but sometimes it’s not.

Whether it's your first time venturing into the great unknown or you're a seasoned entrepreneur used to risking failure, navigating a crisis is daunting. Managing hurdles is not just about stepping over minor pitfalls – it's about knowing how to sustainably mitigate major risks. And more often than not, the ones that get you are the ones you don't see coming.

Managing risk is hard. It can be challenging to know what dangers lurk in your organization and how these risks will affect daily operations, let alone future growth.

A successful risk management plan helps organizations consider their full range of risks and assess the relationships between those risks and strategic goals. These risks can come from various sources such as legal liabilities, economic uncertainties, technology issues, and natural disasters.

Businesses now have many resources to deal with risky situations, such as vendor security and privacy assessment software to manage cybersecurity risks and other tools to manage financial risks.

What is risk management?

Risk management is a process organizations use to identify and manage risks. A risk is an unlikely event or condition that, if it occurs, has a positive or negative effect on one or more organizational objectives.

Every organization faces risks. Whether it's a financial, environmental, or technology risk, each can cripple your business if not properly managed. An effective risk management strategy considers the relationship between the possible risks and the ultimate objectives.

Risk reveals shortcomings and weaknesses, limits our time, and forces us to consider options. And this is good because it means we can explore our options, attempt new strategies, and learn from those around us. Risk equals growth, and risk management helps you identify what’s in your way, challenge you to fix these issues, and assist you along the way.

Risk management is a critical part of every company's operations. As necessities grow and competition increases, organizations often underestimate risks and the potential damage they cause. Risk management and business continuity go hand in hand, growing ever more critical as companies invest more readily and heavily into their IT operations. These two disciplines are often bundled together, though they should be considered separately.

Enterprise risk management (ERM) is a holistic approach to risk management that emphasizes predicting and understanding risk throughout a company. ERM highlights the necessity of managing positive risk in addition to focusing on internal and external threats.

Positive risks are opportunities that, if not accepted, can either create corporate value or harm an organization. The goal of any risk management plan is not to remove all risk, but rather protect and create value for the organization with prudent risk decisions.

The risk management process captures and manages emergent risks and incorporates new knowledge in current risk analysis, reflecting the dynamic nature of project activity.

Types of risks

Suppose you're in charge of risk management at your organization. In that case, you are likely responsible for making sure that not only are dangers to your business addressed but that your business is also capable of meeting its goals. Here are six types of possible threats to consider in your organization.

- Financial risk: This refers to the money that flows in and out of a company and the possibility of an unexpected financial loss. Organizations need solid financial management to meet their goals and counteract economic risk. It's critical to foresee financial risks, assess their impact, and prepare to respond to or avert adverse situations.

- Compliance risk: Government agencies enact a slew of industry laws, rules, policies, and best practices to streamline corporate activities. Failure to comply with these requirements can have significant financial and legal ramifications for businesses, putting company objectives and operations at risk. Conducting a compliance audit and maintaining a thorough understanding of applicable regulations of the Occupational Safety and Health Administration (OSHA), the Environmental Protection Agency (EPA), and state and municipal agencies helps reduce compliance risks.

- Security and fraud risk: There's increased potential for hacking as more consumers use the internet and mobile channels to transmit personal data. Data breaches, identity theft, and payment fraud are examples of how this type of risk increases for organizations. Not only does this risk jeopardize a company's trust and reputation, but it also exposes it to a potential burden in the event of a data breach or fraud.

- Reputation risk: An angry customer, a product failure, negative press, or a lawsuit can harm a company's brand image. In recent years, reputational risk has become even more of a problem for businesses due to social media's growth which offers instant interactions, making it more difficult for companies to control their brand image. Understanding the hazards to your reputation and how to handle them is essential.

- Operational risk: The risk of loss from failed internal procedures, people, systems, and external events, is referred to as operational risk. Global crises, IT system failures, data breaches, fraud, human loss, and lawsuits are just a few examples. These operational risks can have a detrimental effect on your organization’s money, time, and image, whether it’s due to people or process failures. You can handle these potential operational hazards by training and preparing a business continuity plan. Both strategies allow you to consider what could go wrong and plan for a backup.

- Competitor risk: While a company may be mindful of rivals in their market, it's easy to overlook what other companies offer that's of interest to your clientele. The business risk in this situation is that a company leader becomes so comfortable with their success and the status quo that they stop looking for opportunities to pivot or improve. Customers are lost due to increased competition mixed with a refusal to adjust.

There are three levels of knowability to explore for each risk. Project risks are, by definition, unplanned. However, this doesn’t imply that they are always hidden. Understanding risk management entails knowing how much you know about the risks before commencing the process.

Risks are classified into three categories based on the level of knowability.

- A known risk is one previously raised by a stakeholder, colleague, or oneself. It may come up during the project planning phase or just be mentioned by an expert. These must be investigated thoroughly and recorded.

- An unknown risk is one that didn't arise immediately, but can only be known or identified by a select group of respondents, such as an expert or specialist. While creating a business risk management strategy, you should spend some time attempting to uncover these.

- Unknowable risks can’t be realistically predicted, such as overall system failure, a financial collapse, or a catastrophe. While it’s pointless to identify all of them in your strategy, it’s critical to understand that you can’t predict every danger. But it doesn't imply the risks don't exist.

Want to learn more about Vendor Security and Privacy Assessment Software? Explore Vendor Security and Privacy Assessment products.

What is risk analysis?

Risk analysis is the process of identifying and assessing potential concerns that might negatively influence significant business efforts or projects. This practice is carried out to assist companies prevent or mitigate risks. Because risk analysis primarily depends on perception, project leaders must involve stakeholders early in the risk identification process.

Risk analysis examines the probability of unfavorable occurrences induced by natural forces, such as strong storms, earthquakes, floods, and serious incidents caused by purposeful or unintentional human activity. Assessing the potential for damage from these occurrences and their chance is essential for risk analysis.

What is the importance of risk management?

If an unexpected incident occurs, the consequences could be slight, such as a fall in overhead expenses. In the worst-case scenario, it could be devastating, resulting in considerable financial difficulties or possibly the closure of your organization.

This is when risk management becomes a critical component of your overall business plan. Such a strategy helps mitigate any unfavorable occurrences or developments that could otherwise be devastating by detecting and evaluating inherent hazards to your business. Assessing and evaluating risks effectively protects assets, improves decision making, and enhances operational efficiency across the company to save money, time, and resources.

Risk management has never been more critical than it is right now. Because of the increasing speed of globalization, the risks that modern firms confront have become more complicated. New hazards regularly emerge, many of which are tied to and caused by the now-ubiquitous usage of digital technology. Risk specialists and managers now label climate change as a "threat multiplier".

The coronavirus pandemic, which began as a supply chain concern, swiftly became an existential danger, affecting staff health and wellbeing, business processes, consumer interactions, and brand reputations. Businesses quickly altered their systems in response to the pandemic's risks. However, they now have to deal with new dangers in the future, such as workforce mobility and optimization of their supply networks.

Companies and their board members are reconsidering their risk management frameworks as the market continues to cope with COVID-19. They're re-evaluating their risk exposure and looking into risk management practices. Companies that now employ a reactive risk management approach are investigating the comparative advantages of a more proactive strategy. Sustainability, resiliency, and enterprise agility is gaining popularity.

Traditional risk management vs. enterprise risk management

Organizations realize that they can’t operate in a risk-free environment. How they handle the risks is determined by various factors, including sector and company size. Some market segments, such as financial services and insurance, have more developed risk functions than others because their business practices are risk-based. They are subject to laws that compel them to mitigate risk in specified ways.

Risk management exists in sectors where risk isn’t the core business. Still, hazards vary from industry to industry and business to business, as do strategies for managing risk.

There are two approaches you can take to evaluating and monitoring your company's risks: traditional and enterprise risk management. While the concepts are similar, there are several substantial distinctions between the two.

.png)

Traditional risk management

Traditional risk management (TRM) is primarily concerned with loss exposures caused by hazard risk. This technique removes any exposure attributable to business risk from its scope and instead focuses on managing health and safety, acquiring insurance, and regulating financial recovery.

Many organizations think TRM is deceptive and lacks relevant insights into the real and developing nature of risk. This is due to its tendency to emphasize negative scenarios, not to mention its reasonably restricted reach. As a result, TRM is an unstable basis for making informed judgments.

TRM is widely used by businesses and is highly standardized. The two most commonly used standards for risk management by companies are COSO and ISO 31000. Even though both of these standards are up-to-date on the benefits of taking risks and enjoying the rewards, they remain significantly tilted toward risk management and avoidance.

Enterprise risk management

Enterprise risk management (ERM) is an extension of traditional risk management and elevates it to a strategic organizational level in response to a fast-changing risk environment. It assesses risk via a broader lens and allows for a holistic approach that considers both opportunities and threats.

ERM is significantly more dynamic and allows for far more straightforward case-by-case adaptation. No two organizations are alike, and no two businesses are conducted identically. Some business owners are more conventional, while others are more likely to be impulsive and risk-takers. An ERM program is unquestionably focused on the latter.

ERM strategies help stakeholders and boards of directors make educated and informed choices. ERM allows risk teams to collaborate with decision-makers to decide which risks are too high and generate profit.

Here’s a quick summary of the differences between TRM and ERM.

| Traditional Risk Management | Enterprise Risk Management |

| Offers a fragmented approach where each department tends to operate in silos | Takes a more holistic view and is integrated throughout the organization |

| Takes a reactive approach to risk management | Takes a proactive approach to risk management |

| Primarily focuses on insurable risks and financial risks | Considers all business risks and opportunities |

| An ad-hoc process | A continuous process |

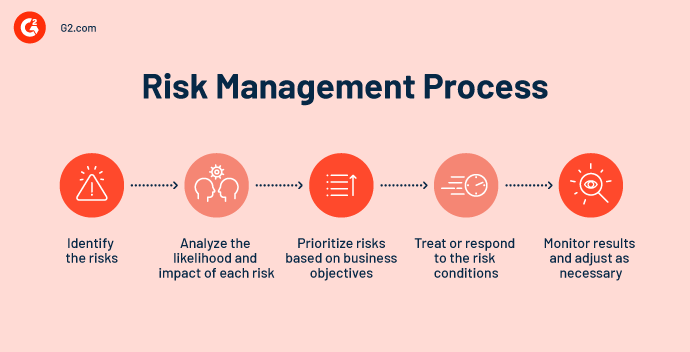

Risk management process

Risk management, in general, entails developing a risk management approach and plan, identifying elements of the risk management framework, and providing advice on actions, practical methods, and technologies for executing each element.

Setting up and implementing a risk management process is similar to installing a fire alarm. Although you hope the alarm never goes off, you're ready to cope with the slight inconvenience now in return for future safety

Many bodies of knowledge in the risk management discipline detail what businesses must do to mitigate risk. One of the most well-known sources is the ISO 31000 standard, established by the International Organization for Standardization (ISO). ISO recommends a five-step risk management approach that any type of company can apply.

Identify

The first step is to identify potential dangers. To examine what could go wrong, one must first examine what must go well. Begin by reviewing your goals and objectives, as well as the numerous resources or assets that permit them. Risk practitioners frequently take either a top-down or bottom-up approach when considering what can obstruct such objectives.

The top-down approach evaluates mission-critical activities that must not be compromised, such as sales transactions in a store or assembly lines in a factory. It then specifies the situations that might threaten those operations.

For the bottom-up approach, risk professionals investigate several known threat sources, such as ransomware attacks or economic downturns, and consider the impact on business.

Here are a few questions to help you determine risks:

- Are there any new or recently revised legal and regulatory laws the team should know?

- Is this risk affecting other aspects of the company? If so, make sure to indicate the risks to that department.

- What occurrences in the past have caught the business off guard?

Anticipating potential project risks doesn’t have to be doom and gloom for your business. Identifying risks is an exemplary process for your entire team to participate and learn. Make use of your whole team's aggregate expertise and experience. Request that everyone identify hazards they have personally encountered or may have more knowledge about. This technique promotes communication and cross-functional learning.

Risks are any uncertainty that influences or affects objectives. The greater the effect of a threat, the greater the priority. Priority examination occurs in the following steps, but first, it's essential to assess the various risk elements to construct a measurable scenario.

Tip: Set a time limit for identifying hazards or you'll remain trapped in analysis paralysis and never proceed on to the following stages. Bear in mind that this is a continual process, so you’ll continue to add risks as time goes on.

Analyze

As previously stated, a risk is only a concern if it affects business. The second stage in the risk management process is to determine the likelihood that a risk will materialize and have a substantial effect.

Risk analysis deals with calculating the probability of a risk event occurring and estimating the severity of the repercussions if it does. While there's typically an immediate effect, there could be additional long-term implications. Therefore, it's critical to account for these variables in the calculations.

Risk analysis also helps determine the priority levels of each risk so that resources for mitigation are neither over or under-allocated in the subsequent stage. This helps risk management teams choose where to focus first. While evaluating each vulnerability, consider facts such as potential financial loss to the company, time sacrificed, and the magnitude of the impact.

For example, say an employee loses their laptop that contains patient records. There's an immediate loss of property, but the loss of that patient data can result in penalties, litigation, and reputational harm much beyond the cost of the lost gadget.

Risk leaders must include time considerations in risk analysis calculations. Financial reporting systems are frequently seen as crucial, but their integrity and availability requirements are critical during tax season. Another time-based aspect to examine is the frequency of risk events.

Tip: When using risk assessment software, it’s critical to map risks to various documents, rules, procedures, and business operations. The system will have a risk framework in place to assess threats and inform you of the far-reaching consequences of each risk.

Prioritize

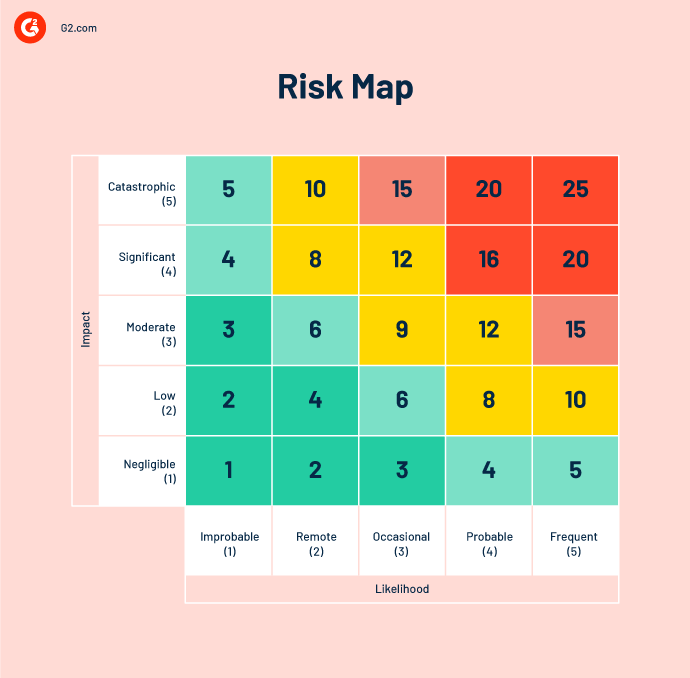

You can evaluate and prioritize each risk using a risk heat map. A risk heat map is beneficial because it visually depicts the nature and effect of a business's risks. This activity is best developed in partnership with senior management.

Risk maps are most successful when firms properly evaluate the numerous risk groups they encounter, the various dangers inside each class, and their potential probability and impact on the business.

Businesses should also keep the following factors in mind while developing risk maps:

- The precise systems and business assets that are vulnerable to various risks

- The nature of each risk's impact on the business (monetary, operational, reputational, etc.)

- Whether there’s an appropriate level of damage, and if so, how much damage is bearable for the enterprise

- Current internal controls and any new measures that’ll be installed

- Risk tolerance and risk appetite of the company

While the initial risk prioritization may be based on a mix of possibility and effect, the final ranking is impacted by elements essential to the stakeholders. For example, if the company's current leadership believes that customer trust is a vital value, risks that impact consumers are prioritized. By scrutinizing each risk, a business can identify any recurring difficulties throughout a project and better streamline the risk management strategy for future projects.

Tip: It's critical to remember that risk maps aren’t static. Businesses must regularly analyze their risk maps to ensure that significant risks are appropriately handled. They should also have a process in place for evaluating and revising their risk maps as threats and vulnerabilities emerge.

Treat

Every risk must be reduced or eliminated to the greatest extent possible. This is accomplished by establishing contact with experts in the area where the risk exists. This stage is also known as risk response planning.

During this stage, a business evaluates its highest-ranked risks and addresses or adjusts them to achieve acceptable risk levels. You develop risk reduction strategies, preventive measures, and contingency plans in this stage. Once completed, add the risk treatment strategies for the most critical or highest-ranking hazards to your project risk register.

Below are a few aspects to consider as you develop your mitigation strategy:

- No additional treatment is required if the risk is already at an acceptable level based on the organization's risk appetite.

- Transfer some of the risks to another business, such as an insurance company or an outside service provider.

- Substantially limit the chance or effect of each risk to an acceptable standard using various management, technological, and administrative risk controls.

- If none of these risk response strategies can be used, risk managers must prevent the risk by removing the operations or situations that would allow the scenario under review to occur.

It's critical to ensure that the procedures used are efficient and cost-effective. The resources allocated to treat the risk should be proportionate to the safeguarded assets.

Tip: It's tempting to choose mitigation strategies over current operational processes. You won't be able to put every plan into action straight soon. Try to strike a balance between how you execute risk mitigation measures and ensure that the weight of risk management doesn’t interfere with operations. You also don't want to compell a whole process to be overhauled merely to reduce the risk you placed in the green zone of the risk heat map.

Monitor

Even after completing each stage, you must track and monitor performance to ensure that risks stay within the limitations defined by the organization's leadership. Risk factors, asset prices, and stakeholder preferences can shift quickly.

The risk monitoring stage includes evaluating the status of risks, assessing the efficacy of mitigation methods implemented, and interacting with relevant stakeholders. Risk monitoring should take place at all stages of the risk management process.

Here are some questions to consider while monitoring risks:

- How can I keep the other department heads interested in assisting with risk management?

- How can I train my team to identify and prioritize risk occurrences?

- Is there any evidence that a danger initially defined as high risk should now be classified as a low threat, or is it the other way around?

An essential component of monitoring is ensuring that managers and senior executives are updated on progress toward risk targets and developments that may impact the company. As diverse teams across the company take steps to detect, assess, and respond to risk, the outcomes influence and enhance the next iteration.

Effective communication among your stakeholders and team members is critical for constant threat monitoring. And while it may feel as though you're herding cats, keeping track of those fluctuating goals is important with your risk management strategy and project risk register in place.

Tip: Don't use a "wait and see" approach, because you may not realize when a risk event has transpired. Events such as cyberattacks and regulatory changes are sometimes discovered months or even years later, despite the security measures and risk management strategy in place. Make sure your risk management strategy incorporates continuous monitoring so you aren't taken by surprise when continuous monitoring could have helped you take action sooner.

How to create a risk management plan

A risk management plan is a completed document that outlines all the potential risks associated with an idea. It's usually outlined in the business plan or business case, submitted to stakeholders at the start of a project.

A comprehensive risk management plan will often include the following elements.

- Communication and collaboration: Since developing risk awareness is an essential component of risk management, leaders must also design a strategy to communicate the organization's risk policy and protocols to staff and other stakeholders. This stage establishes the tone for risk choices at all levels.

- Setting the context: This phase involves establishing the organization's distinct risk appetite and risk tolerance, or the extent to which risk might differ from risk appetite. Business objectives, company culture, regulatory laws, political climate, and so on are all factors to consider here.

- Risk identification: This stage identifies the risk scenarios that could influence the organization's capacity to do business, either positively or negatively. As previously stated, the final list should be documented and maintained up to date in a risk registry.

- Risk analysis: This phase examines the likelihood and effect of each risk for further classification. A risk heat map can offer a visual picture of the type and impact of a company's risks. For example, an employee calling in sick is a high-probability occurrence with little or no effect on most businesses. An earthquake is an example of a low-probability risk with a significant impact, depending on where it occurs.

-

Risk evaluation: This is the stage at which businesses decide how to respond to the threats they encounter. Below are the most common risk evaluation approaches:

- Risk avoidance occurs when companies remove, withdraw from, or refrain from participating in possible risks.

- Risk mitigation occurs when an organization takes steps to reduce or optimize a risk.

- Risk sharing or risk transfer occurs when the business enters into a contract with a third party (like an insurer) to shoulder some or all of the expenses that may or may not arise.

- Risk acceptance occurs when a risk fits within the risk appetite and tolerance of the company and is accepted without action.

- Risk monitoring: This stage requires identifying and implementing systems that rigorously assess the objectives, risk ownership, compliance with policies established via the governance process.

- Risk reporting: This stage helps businesses assess and evaluate their risk management plan. It also keeps stakeholders involved in risk mitigation by sharing progress. Risk management software is helpful during this phase to collect all of the data points and provide an easy-to-read dashboard.

Risk management best practices

Whether you're developing IT risk management strategies for a vendor or assessing your own company's risk assessment strategy, you need a plan. Here are some of the crucial risk management best practices to consider.

- Conduct a business impact analysis (BIA). Conducting a BIA goes hand in hand with risk analysis. It's an excellent method for identifying the risks that’ll have the most impact on your business.

- Determine the action items and their owners. Identify action items that emerge from the risk register and their owners. Assign risk owners to their respective risks.

- Begin identifying threats in the early phases of the project. Begin the risk identification process as soon as the project starts. Thoroughly examine the assumptions and terms and conditions specified in the proposal or statement of work (SOW) document.

- All stakeholders should be kept up to speed on the risk statuses. Try to communicate regularly, especially with weekly status updates.

Benefits of risk management

Risk management isn't always a popular topic, but it does prevent disasters from taking place. It's the insurance policy to your strategy and gives you peace of mind that you're protected and your hard work and investment won't go to waste without a return.

When well done, risk management safeguards your reputation and saves you time and money. Yet, few businesses have a process in place to manage it effectively. Below are some benefits of risk management.

Forecasting potential threats

One of the advantages of risk management is that it transforms a company's culture. Businesses that place a greater emphasis on risk management are more proactive. Risk management requires organizations to examine each of their business operations and determine what may go wrong. This extensive what-if survey helps businesses become more proactive and forecast potential challenges.

Companies that employ risk management extensively have fewer business disruptions since such concerns are anticipated and addressed at an early stage. A proactive strategy is beneficial since it allows businesses to detect failing initiatives early.

Improves business operations

The daily activities of risk management demand that organizations gather an increasing amount of data on their operational processes to identify the elements of the process that are unproductive or have room to improve.

Risk management teams are also responsible for regularly monitoring the operations of several departments with respect to external entities and potential problems. As a result, various possibilities are recognized and procedures are enhanced. Risk management methods frequently coexist alongside business process reengineering and process quality enhancements.

Better customer experience

Risk management planning can have a significant impact on how your business operates. Better organizational efficiency and consistency contribute to happy consumers. Improving information security helps you avoid downtime, impacting your customers' satisfaction. A company that expands sustainably attracts more satisfied consumers.

Challenges of risk management

Savvy executives undoubtedly know that effective risk management is critical for successful businesses. They also understand that failure to use effective risk identification and assessment strategies could lead to significant losses in product quality, service delivery, and market share.

Here are some challenges of risk management.

Integration with business practices

The danger of risk management is that business leaders perceive it as a purely bureaucratic exercise. This can cause them to overlook its importance or invest in prevention systems that aren’t appropriate to the nature of the risks they face. Most business executives consider risk management planning as a compulsory regulatory task they must complete to meet market expectations.

Risk management is frequently consigned to a lower-level function that addresses essential but non-strategic concerns. As a result, risk management initiatives inside an organization are insufficiently connected with strategic planning. This is partly influenced by how risk managers have led their risk identification and assessment initiatives.

Increased expenses

Risk management and planning require businesses to shell out money. Companies will need to increase their cash-generating strategies to fund training and upkeep for something that hasn't yet occurred.

It’s a risky business

Managing risk is one of the most important responsibilities a business faces each day. Investing in risk management is the only way to ensure that your company will continue to prosper.

Resolve to be proactive, not reactive. Understand the risks and address them before they matter.

Want to know more about project management? Discover everything you need to know about project planning to ensure success.

Keerthi Rangan

Keerthi Rangan is a Senior SEO Specialist with a sharp focus on the IT management software market. Formerly a Content Marketing Specialist at G2, Keerthi crafts content that not only simplifies complex IT concepts but also guides organizations toward transformative software solutions. With a background in Python development, she brings a unique blend of technical expertise and strategic insight to her work. Her interests span network automation, blockchain, infrastructure as code (IaC), SaaS, and beyond—always exploring how technology reshapes businesses and how people work. Keerthi’s approach is thoughtful and driven by a quiet curiosity, always seeking the deeper connections between technology, strategy, and growth.